Last Updated on November 8, 2021 by Stephan Lindburg

Automated trading systems aren’t actually all that new. They’ve been used extensively for foreign currency exchange (forex) markets for decades and are often used for stocks and other assets as well, often helping those traders generate consistent profits. Trading bots are becoming popular in crypto for the same reason they’re so widespread in forex and CFD trading. Regular fluctuations in value create an opportunity to profit if the trades can be timed just right.

Computer systems play an essential role in any trade, but the critical difference when it comes to automated trading is that the computer is the one making the buy and sell orders, not just executing them. Once set in motion, the system makes trades without any input from the trader, running 24/7 on their behalf.

Can Crypto Trading Bots Really Help You Turn a Profit – If So How?

Contents

- 1 Can Crypto Trading Bots Really Help You Turn a Profit – If So How?

The earliest versions of algorithmic trading date back before computer use, simply involving a set of rules that traders decided to follow regardless of their feelings. With computers, the set of rules can be much longer, much more complex, and involve complicated technical indicators that draw information from many real-time sources.

What Exactly Do Crypto Trading Bots Do?

In general, a trader will link up a crypto trading bot to an account that they have on Coinbase, Kraken, a CFD broker, or a random exchange. They hand over control, letting the bot make buy and sell orders on their behalf.

Most bots are going to have a variety of settings, some having a wide selection of strategies to choose from. For example, traders can adjust their risk tolerance or a preference for certain assets or even set the bot to mimic the trades made by well-known successful investors.

So what does the bot actually do once it’s been turned on? Well, it does the same thing that human traders do, just much faster. The bot will have access to a wide variety of market data, including the current price and volume of any cryptocurrencies it can access through your exchange.

With this data, it can perform calculations to predict if assets are headed up or down in value. It’s a lot like getting trading signals based on market analysis, but the bot puts them into action immediately. The core tenets are the same as everyday trading, buy low and sell high. Because the strategies available with different bots vary, so will the results that traders receive.

The developers who create these trading bots and their strategies aren’t doing it for free. The most common revenue model is taking a percentage off of every trade made. Some automated trading systems require monthly subscription fees instead of, or on top of these percentages.

How Are Bitcoin Robots Better Than Human Traders?

While many developers might overpromise with their crypto trading bots and traders might have excessive expectations, they can, in fact, be valuable tools for implementing trading strategies. They have a number of key advantages that lend them to certain situations and can help traders find specific solutions that meet their risk tolerance and strategy.

Watching the Markets Every Second of the Day

If you were to invest in the stock market, you likely wouldn’t be sitting there all day watching your investments. In fact, you might not even check them for extended periods of time if they’re long-term investments. Not to mention the fact that even if you do watch the markets, you’ll be able to sleep after they close and even enjoy national holidays.

With cryptocurrencies, the markets never close. Prices fluctuate wildly throughout the day and over longer periods of time, and that includes when you’re asleep. You can’t watch prices 24/7, so what happens if the cryptocurrency of your choice starts crashing and you’re not there? Automated trading bots can watch prices non-stop, making it possible to react to every single market event. This feature is commonly referred to as “stop-loss” or reverse signal.

Of course, this also applies to time that you could spend actively investing but rather wouldn’t. Traders can leave these bots on and go about their days instead of babysitting their cryptocurrencies. The increased efficiency lets investors capitalize on more market developments, ultimately allowing them to work more actively towards their investment goals.

Leaving Your Emotions at the Door

One of the biggest challenges that investors face is dealing with their own emotional reactions. When you see the value drop, you can panic and try to sell. Conversely, when you see something rising, fear of missing out drives you to buy. However, this kind of behavior ultimately leads to traders buying low and selling high. Instead, they would have been better off simply leaving their account alone and riding out any turbulence.

Crypto trading bots, on the other hand, have no emotional attachment to your investments. Their decisions are based on the algorithms and calculations that go into their trading strategies. Whatever results you might get in the long run, they aren’t going to be because the bot panicked or picked favorites.

Furthermore, when trading manually, your gut reaction is about the only reaction you can rely on quickly. Even if you knew how to carry out market analysis, you wouldn’t be able to do it quickly enough. When the next candlestick pops up on the chart, you don’t have time to do calculations for an instant decision, but the automated trading bot does.

Access to Advanced Market Analysis

Because crypto bots run on computers, they can carry out a series of complex calculations incredibly quickly. Among these complex calculations are certain types of market analysis that can provide predictive insight into market trends. Crypto bots make use of some of these to deliver better results.

These analyses include some that have been used in stock and forex markets for decades. Bollinger Bands rely on a moving average to generate upper and lower bands to quantify volatility. Basically, it’s a way of looking at the constant fluctuations in crypto price to determine if it’s normal or if something strange is happening.

The bots can also rely on a Fibonacci retracement, ratios that connect relative highs and lows in order to predict future trends. Stochastic oscillators for cryptocurrencies can evaluate current price vs. historical prices to tell if it’s been overbought or oversold. There are many more indicators that crypto bots can incorporate into their strategies, and they can calculate them far faster than any human trader.

Automated Crypto Trading Isn’t for Everyone

Like any tool, automated trading isn’t going to be the right choice for every single situation. For many investors, the idea of handing over control of their crypto assets to a trading bot is unsettling. They feel the need to stay in control at all times and will repeatedly check in on the bot throughout the day. Traders might even try second-guessing the bot, interrupting its strategy, and letting emotions back into the picture.

For the most part, trading bots can let you get in on specific currencies as they’re on the upswing and get out before a downswing causes significant losses. If you’re investing more than you can really afford in the hopes that trading bots can help make you a small fortune, you’ve dangerously misunderstood what their intended purpose is and are at risk of losing your money or even falling for some of the scams out there.

What Automated Trading Can’t Do

While automated trading bots have a wide variety of practical uses, they can only do so much. There are some very concrete restrictions on their abilities, and there are always risks involved when handing over control of your cryptocurrencies to an automated system.

First of all, crypto trading bots only work with exchanges or brokers that they’ve been designed to work with. This can restrict access to specific cryptocurrencies, and you certainly won’t be able to capitalize on low market cap coins on their way up. However, that’s likely for the best, as focusing on core cryptocurrencies can help reduce risk.

Second, while their algorithms are very impressive, they’re based on analyses of past events. That means, when something truly unexpected happens, the bot might not make the right call. Whenever the analysis tools at their disposal fail, the bots will fail as well. While they’ll often be able to remedy their mistakes far faster than any human could do, there’s still a serious risk here.

Letting trading bots run 24/7 can protect you from sudden market swings, but it also means the bot itself is unsupervised for long stretches of time. You might wake up to find that the bot has lost a sizable portion of your cryptocurrencies through some well-meaning but ultimately mistaken decision.

Traders often also underestimate how complicated setting up a trading bot is going to be. It’s not the most difficult thing to do in the world, but crypto trading bots really are better for people who have some knowledge of trading. In most cases there are numerous parameters to be set to ensure that the bot will be implementing the kind of strategy you’re looking for. Failing to understand these parameters can lead to the bot taking risks that the trader would consider excessive.

The Widespread Use of Crypto Bots for Investment Scams

When you make the decision to use a well-known crypto bot on a cryptocurrency exchange, you’re taking on an informed risk. You know the system isn’t perfect, you know it has limitations, but you believe the potential rewards outweigh the risks. However, there is another kind of danger to be found when looking for automated crypto trading.

Scammers from numerous countries around the world are using automated crypto trading as bait for their investment scams. If you’ve seen any ads on social media for crypto bots, you might very well have seen ads for these scams. They’re incredibly widespread, and social media websites are doing little to nothing to combat that spread.

The best way to protect yourself is to go with a trusted crypto bot that many other investors already use. Of course, this means you won’t be getting any kind of exclusive advantage. That fear of missing out is exactly what these scammers prey upon. They will tell you that their new system is revolutionary, that people are doubling their money day over day, but they are simply lying.

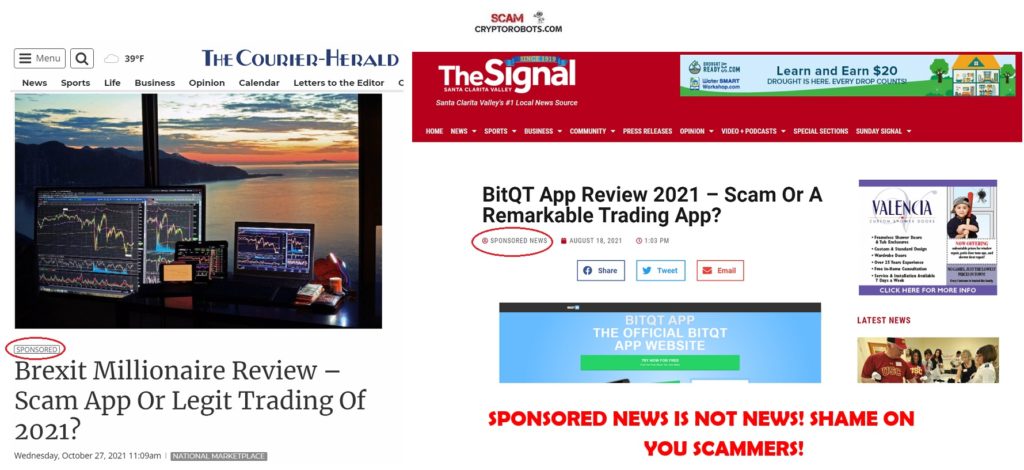

The quickest way to know that you’re about to become the victim of an automated trading scam is when a certain bot starts receiving too many sponsored or paid promotional articles. This means that the reviews are not independent and chances are you will not be linking a bot to your account at an established exchange or CFD broker, but instead going to an obscure website and making a deposit to trade there.

That’s how the scammers operate and how they’ve operated for years. They don’t have advanced crypto bots. That’s just what they promise their victims. They’ve done the same thing for years with deposit bonuses, leverage, celebrity endorsements, and more. Once you’ve made your first deposit, that money is gone for good.

Finding a Crypto Trading Bot You Can Trust

While it’s a lot better than it has been in the past, navigating the world of cryptocurrencies is still challenging and often risky. You need to put your trust in the software you’re using and the team behind the crypto bot you choose. There are plenty of exchanges or brokers today that have been around for years that are about as trustworthy as any other kind of situation. However, the vetting process isn’t quite so simple for the crypto bots themselves.

You want to find an automated trading system that’s transparent and open. Cryptocurrencies, in general, provide a permanent record of transactions in their blockchains, so it’s easy enough to verify that transactions are genuine after the fact. However, if they’re using their own platform, you’ll never know if the numbers they’re showing represent actual cryptocurrency transactions.

Many crypto ventures of various kinds are handled anonymously, and for some things, that works. However, you should know where your crypto bot comes from and who made it. Any reputable crypto bot is going to have a well-made website with info about their team. They’ll also have plenty of reviews online about their bots. To be as safe as possible, well-established crypto trading bots will have been featured in stories on reputable online news sites that you can check out.

While crypto trading bots can help you profit and mitigate risk, they come with their own risks. Taking just a little time to be vigilant is an absolute must when it comes to handing over access to your investment funds.