Last Updated on October 31, 2021 by Stephan Lindburg

Automated trading has quickly become a mainstay among crypto investors. However, automated Bitcoin trading has also given a wide range of opportunities for negligent exchanges and outright scammers to harm investors. What do regulators have to say about automated trading, and what are they doing about it?

Becoming a successful trader in any type of market requires years of experience, plenty of insight, and a bit of luck never hurt anyone either. For many, the challenge proves to be too great, and they eventually see their investments generating losses instead of profits.

How Regulators Are Grappling With Automated Crypto Trading

Contents

- 1 How Regulators Are Grappling With Automated Crypto Trading

- 1.1 What Exactly is Automated Trading?

- 1.2 Automated Trading Tools for Crypto Exchanges

- 1.3 Automated Crypto CFD Trading Scams

- 1.4 Choosing the Right Automated Crypto Trading Bots

- 1.5 The Current Regulatory Situation

- 1.6 Governments Continue Ongoing Effort Against Automated Trading Scams

- 1.7 Binance’s Trouble With Crypto Derivatives

- 1.8 The Shape of Automated Crypto Trading to Come

In the hopes of getting better and faster results, some traders turn to automated trading. Automated trading makes use of algorithms to correctly identify when to buy and sell assets. When people try to do this on their own, it’s called timing the market. Timing the market is incredibly difficult, and most who try simply end up losing more and more over time. This is true for all types of investments, and it’s even more difficult when dealing with cryptocurrencies due to their volatile nature.

What Exactly is Automated Trading?

Automated trading is basically letting machines or bots trade for you. There are countless types of automated trading bots online today, thanks to the rapid growth of cryptocurrencies. There’s money to be made providing investors with all sorts of tools and advice, and there are certainly many examples of automated trading offering far more than it can deliver. However, no one really talks about the legal or regulatory aspects of automated trading vis-à-vis cryptocurrencies, and that is just what we aim to discuss today in our article.

The European Securities and Markets Authority (ESMA) has very strict guidelines in place for anyone who wishes to operate in a regulated environment. Issues such as governance, good practices, MiFID or the Markets in Financial Instruments Directive which is designed to create more transparency and disclosure, are all part of the trading guidelines which are outlined in a very detailed manner on the ESMA website.

The same is true for ASIC, which is the Australian financial regulator which has extremely strict market integrity rules in place which are designed to protect its citizens.

Some websites offering automated trading tools are not just scams, in some cases the authorities have been able to identify digital breadcrumbs or “finger prints” that are outright criminal. That being said, it can be difficult for investors to gauge exactly what to look for when evaluating automated trading tools, and it depends on which kind they’re looking into.

Automated Trading Tools for Crypto Exchanges

The most common type of automated trading is carried out by giving control of your account with an established crypto exchange like Coinbase, Binance, or Kraken over to automated trading software. The algorithms therein monitor market data in real-time and carry out trades on your behalf. While they can vary in how successful they are, many of these trading bots are perfectly legitimate. They can often be accessed through the exchanges themselves or downloaded as an app.

The results that traders get depend on which specific bots they go with and which strategies those bots implement. Some are rather simple, acting like more sophisticated stop-losses that catch signs of an impending dip and sell ahead of time. Others implement much more complex strategies based on more advanced technical indicators.

There’s also the same kind of diversity that you’d expect to see when choosing ETFs or managed funds. You can find automated trading bots that are aggressive and risky, or bots that are conservative and focused on long-term growth.

Of course, the developers behind these trading bots aren’t helping investors out of the kindness of their hearts. Anyone who uses a trading bot will be paying a trading fee, typically a fraction of a percent, a subscription fee, or both. Some well-established automated trading bots have performance records that show the cost can be well worth it.

However, these automated trading bots are sometimes the basis for scams. Anyone investing this way is taking on some risk, but traders who go with automated trading bots that don’t have established reputations could be simply handing access to their crypto exchange accounts over to scammers. We have seen real-live examples of phishing scams with automated trading as the bait. However, there are other ways that automated crypto trading is being used to defraud investors.

Automated Crypto CFD Trading Scams

Cryptocurrencies have become one of the most popular assets to use for CFD scams. CFD stands for “contracts for differences.” They’re derivative assets that serve as an agreement to pay the difference between another asset’s price today and at a later point. Essentially, they let people invest in an asset without the buyer or seller ever having held the actual asset itself.

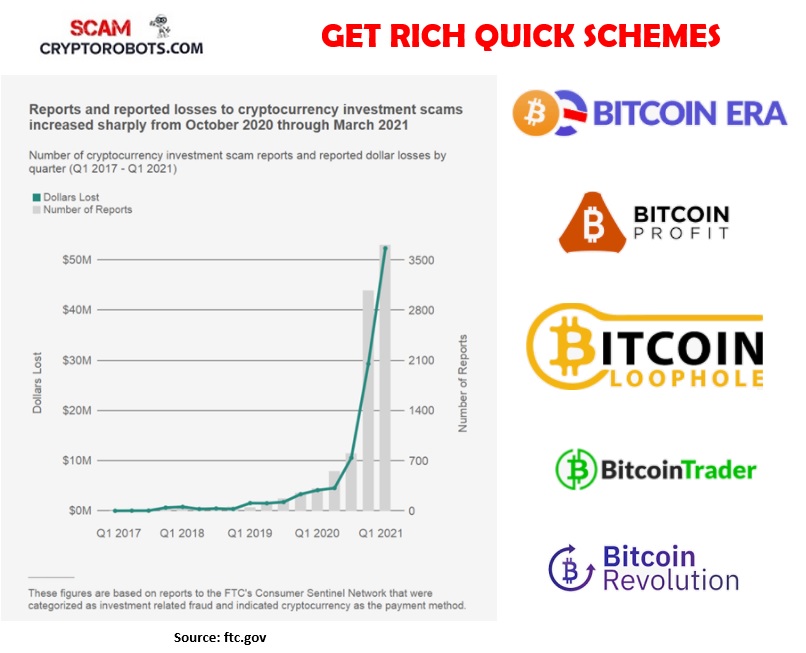

While fast-moving assets like Forex have long been a favorite for both legitimate CFD investors and scams alike, they’ve quickly been supplanted by Bitcoin and other cryptocurrencies. CFDs themselves occupy somewhat of a legal grey area in many countries, and scammers take advantage of this fact to swindle investors.

The main question here is why anyone would want to buy CFDs instead of owning cryptocurrencies directly. The answer is that the profits can be extremely high. Scammers know this and tempt their victims with a variety of different sales tactics.

Leverage is one of the most common, letting traders extend their positions upwards of 100 times over in the hopes of getting rich quickly. Of course, this leverage can also drain their accounts just as fast.

CFD scams also typically offer bonuses of some sort, often doubling any trader’s initial deposit. Both the practice of deposit bonuses and excessive leverage are heavily regulated or banned in most countries, but many CFD scams don’t have any kind of license or even an official physical presence in any country.

The latest way that CFD scams have been luring crypto investors has been through the promise of automated trading. The key difference here is that they’re not offering automated trading bots to handle your funds on another exchange.

They only provide automated trading on their own platform. That means that anyone interested has to send them actual money to get started, often with minimum deposits in the range of $/€/£250.

At this point, the scammers have essentially won the day. They have their victim’s money, and it doesn’t really matter what justification they offer for keeping it. Many such scams claim that the investors haven’t met eligibility requirements for withdrawals, or they might say that the automated trading system has reduced their balance to zero. In either case, the promise of huge automatic trading profits has soundly relieved the naïve trader of their hard-earned money.

Choosing the Right Automated Crypto Trading Bots

While there are plenty of scams out there, automated trading is also a legitimate practice that investors might be interested in. Avoiding scams can be relatively simple if you follow the right steps, but keep in mind that you’re still opening yourself up to risk even with legitimate automated trading.

Only go with established bots that work through a reputable exchange or tested CFD trading system. Don’t follow social media ads, don’t send anyone a deposit, find automated trading with a long history and a wide user base. These three bots are prime examples of what you should be looking for.

Coinrule

Coinrule serves as a good middle ground when it comes to automated trading bots. It’s simple enough for most beginners to use but has enough advanced features to really let traders take control of their strategies and goals. There are over 150 strategy templates that users can adjust as they see fit, and you can see how your strategy would have fared based on historical price data.

Shrimpy

Shrimpy is has some of the widest exchange support, with over 18 different options available. These automated trading bots are based on a practice called social trading that copies the trading profiles of successful expert investors. Shrimpy also has an extensive dashboard where traders can see statistics about their assets and performance.

Pionex

Pionex provides 12 different automated trading bots that each implements its own effective strategies. They have some of the lowest transaction fees of any crypto trading bots out there, letting investors keep as much of their profits as possible. They are relatively beginner-friendly and have plenty of support options for their users.

All three systems above are not recommended to any of our members since they are too complicated to use and operate. The settings, and extensive requirements which are needed in order to get started trading leave our viewers tedious, irate, and frustrated.

The Current Regulatory Situation

Both automated trading and the scams based on it have spread around the world. As such, they’re both subject to the complexities of different laws in different countries. In general, most countries have no problem with automated trading itself but have taken major steps in taking down related scams.

In the UK

In the UK, the use of automated trading bots on cryptocurrency exchanges is perfectly legal. In practice, it’s not much different from deciding to take computer-generated advice on your trades, just much faster. Cryptocurrency traders in the UK are free to use such tools as they see fit. The issue in the UK is CFD trading, and the FCA has placed heavy restrictions on trading CFDs due to growing complaints related to scams.

In Europe

Trading cryptocurrencies through exchanges is considered legal by the European Union, although individual countries have the option of instituting their own unique regulations. The European Securities and Markets Authority is mainly responsible for protecting European investors from scams, having previously banned assets like binary options.

ESMA currently has strict regulations around crypto CFDs that serve as the basis for automated trading scams. There was a temporary restriction placed on the sale of CFDs between 2018 and 2019, although the ESMA did let it expire. This is generally considered to be due to the adoption of specific CFD regulations by most constituent nations, including France and Germany.

In Australia

Australia is another primary target for automated trading scams. While automated crypto trading itself is legal when carried out properly, the Australian Securities and Investments Commission has taken action to reduce the impact of scams. This includes a warning issued in August 2021 against trading any crypto-related assets through unlicensed entities.

ASIC has regulations that limit the use of CFDs in general, limiting the leverage that legitimate brokers can offer. They’ve also started to take a negative stance on crypto derivatives as well, banning popular exchange Binance from selling crypto futures and options, with a deadline of December 24, 2021, for investors to close out their positions.

Governments Continue Ongoing Effort Against Automated Trading Scams

Various types of derivative assets have been used as the basis for scams for decades, and financial regulators and police agencies around the world have been trying to crack down on them for just as long. They’ve already made some major moves in fighting back against the latest wave of automated crypto trading scams.

From July 2019 to June 2020, the FCA opened investigations into 52 unauthorized businesses trading cryptocurrencies and crypto derivatives. While its true that a complete ban of crypto derivatives helps simplifies things, the FCA has also shown a history of banning individual organizations when necessary to protect retail investors.

Before Brexit, many seemingly legitimate brokers offered crypto derivatives and automated trading by establishing their presence in another EU nation and using passporting eligibility to provide investment products to UK residents. While this is no longer the case, countless organizations continue to operate automated crypto trading scams without the pretense of legitimacy.

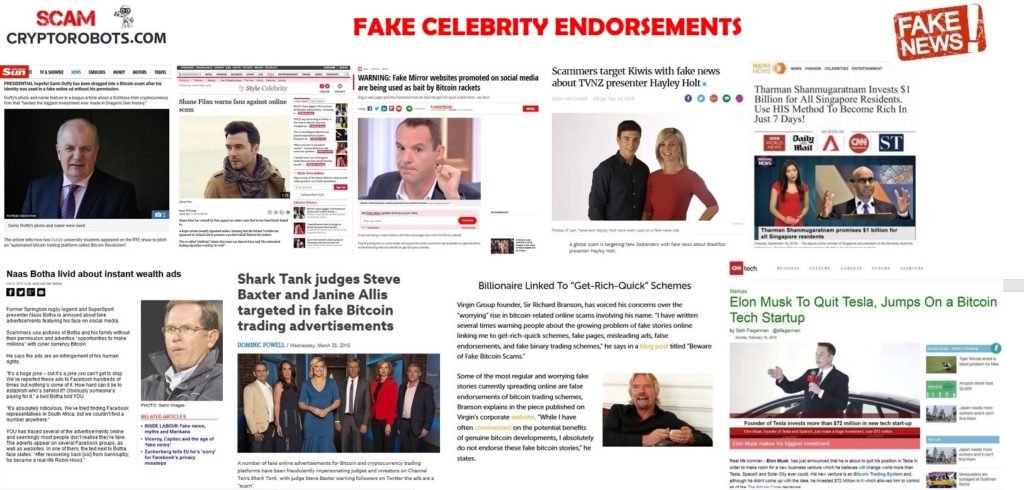

It’s a known fact that fake celebrity endorsements and scams go hand-in-hand, and we have also seen multiple alerts and warnings issued by government regulators about this type of false or misleading advertising.

Binance’s Trouble With Crypto Derivatives

Crypto derivatives, in general, have come under fire from just about every front. Even without counting their use in automated trading scams, regulators are against the assets due to their lack of a solid foundation and potential for excessive risk to retail traders. Most exchanges simply don’t offer any crypto derivatives or futures contracts, but Binance still does.

Binance is the world’s largest crypto exchange, and it seemingly intends to throw its weight around. Their continued offering of crypto futures and options has led to specific warnings against using their services in the UK and Japan and an ongoing investigation by the US Commodity Futures Trading Commission.

While Binance’s sale of legitimate but risky crypto derivatives is only tangential to the use of similar assets as bait for automated trading scams, their current struggle shows that regulators are putting more and more pressure on derivatives every day.

The Shape of Automated Crypto Trading to Come

In general, the reaction by regulators in most countries to automated Bitcoin trading has been sensible and prudent. While many of the subtleties of cryptocurrencies can escape regulators, they seem to understand that automated trading in and of itself is not the issue here.

Instead, they’re choosing to focus on regulating potentially dangerous derivative assets and tracking down scammers who exploit naive traders. Their efforts are making the markets that much safer for traders who’d like to give legitimate automated trading a try.