Last Updated on April 26, 2022 by Stephan Lindburg

Facebook Scam Sees Hopeful Investor Lose Thousands to Fake Crypto Investment Platform

Cryptocurrency scams have become a major threat online, and one Australian woman has found this out the hard way. Anna Rogers of Sydney has lost $8,000 to an online scam that she found through an ad on Facebook, a platform that has become a haven for these types of fraudulent investment opportunities.

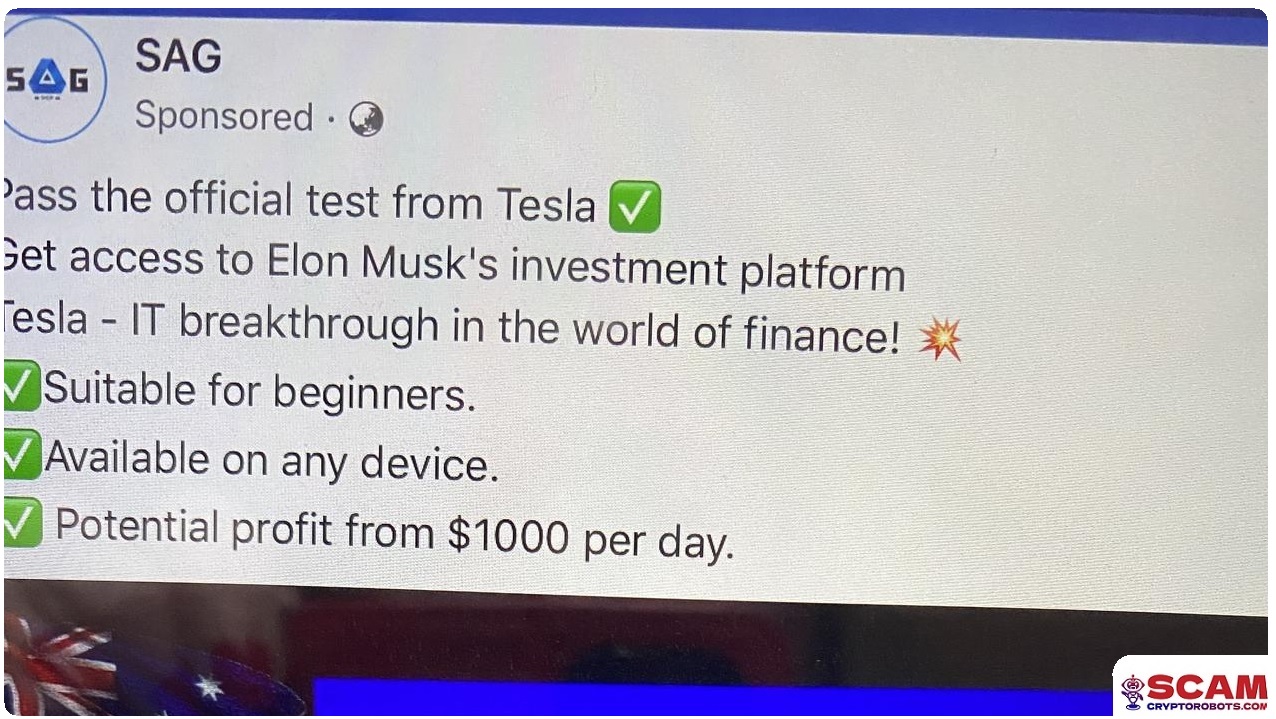

Like many similar fake ads on Facebook, the scam positioned itself as coming from a trusted celebrity name. The seemingly official post claimed to feature Tesla founder Elon Musk’s unique investment platform, promising a potential profit of upwards of $1,000 each day for even inexperienced investors.

This wasn’t just a post making the rounds on social media but an actual advertisement on Facebook’s platform. These take the form of sponsored posts, which look like they’re coming from reputable companies. This gave the scam an even more official appearance, one that managed to draw Ms. Rogers into its malicious trap.

Scammers Took as Much as They Could From Ms. Rogers

Simply clicking on the ad brought Ms. Rogers to a seemingly genuine website claiming to offer investment opportunities in crypto, forex, stocks, and more.

By all means, the website looks like a perfectly legitimate trading platform. However, just because a website looks professional doesn’t mean it is.

Thinking she had found a fantastic opportunity, Ms. Rogers signed up and soon received a call from one of the platform’s representatives. The supposed helpful agent of the website offered to show Ms. Rogers around the platform and help her to start making investments. However, things quickly went downhill.

Shortly after the beginning of their conversation, the representative asked Ms. Rogers to download the popular remote computer access software AnyDesk. This is a hallmark of many types of online scams, whether they’re based on crypto investments or tech support. Once she downloaded the app, Ms. Rogers had given complete control of her computer to the scammers.

The representative used the software to remotely show Ms. Rogers how to invest through the platform, urging her to make a massive investment of $10,000 in Bitcoin that they claimed could be sold on different markets for instant profits. This is, of course, not how cryptocurrencies work at all.

While Ms. Rogers didn’t have $10,000 available at the time, she did agree to transfer $3,000, still under the impression that it was a legitimate investment opportunity. While her first attempted bank transfer was rejected by her bank, she went on to send the funds from an account at a separate bank, ignoring this ominous warning sign.

Within days, her account on the platform showed a profit of $2,000 on her initial $3,000 investment, a great return for any opportunity. As time went on, she continued to receive updates on the growth of her investment. However, these updates soon turned into encouragement to make further deposits.

Ms. Rogers made another deposit of $5,000, at which point she stopped receiving any calls from the platform’s representatives. When she tried to contact them herself, she found that the line had been disconnected. She eventually reported the transactions as fraud to her bank, but it was simply too late, and the damage had been done.

Australia Continues to Battle an Influx of Online Crypto Scams

Ms. Rogers is far from alone in the challenge she has faced. These types of scams are incredibly widespread around the world, and few victims ever see any justice. The issue has become so prevalent in Australia that the country’s investment watchdog agency is currently suing Facebook for its role in hosting the fake celebrity ads that lead to the scams.

Australians lost over $129 million to cryptocurrency investment scams in 2021, many losing similar or even greater amounts than Ms. Rogers. These scams have a very consistent mode of operation, relying on affiliate marketing to spread ads and fake news stories about their investment opportunities. They use celebrity names and outrageous promises to get potential victims to sign up.

From there, they start receiving the same kinds of calls that Ms. Rogers had from supposed platform representatives. Their tactics can become incredibly aggressive, with many victims experiencing round-the-clock calls and even threats from scammers. However, there are some steps that people can take to protect themselves from these scams.

How You Can Keep Yourself and Others Safe

Anyone can fall victim to this type of scam if they aren’t careful. Social media users should always remember that anyone can take out a Facebook ad and that they have no reason to believe they’re legitimate. These opportunities that look too good to be true are often just that, so remain skeptical about offers of guaranteed returns, instant profit, and automated trading.

If you believe you’re already the victim of an online investment scam, you should break off contact with the scammers immediately. Make a report to the appropriate watchdog agency in your country and contact your bank to start a fraud investigation. In doing so, you can help prevent the same thing from happening to others in the future.

Reference/Images/Credit: News.com.au