Last Updated on May 4, 2025 by Stephan Lindburg

Finance Phantom is a newly-launched and illegal get-rich-quick cryptocurrency scheme. It’s advertised as a “highly profitable” AI-powered robotic trading app for cryptocurrencies such as Bitcoin or Ethereum. The purpose of this fake crypto robot is to obtain personal information such as name and email from new customers who can also be described as “opportunity-seekers”. New clients are baited by the use of fake news articles and deepfake videos on various media outlets or social media.

Once viewers are exposed to these fake stories in their news feed or as advertorial-style ads, they are instructed to provide contact information. These deceptive advertising tactics are designed to convince victims that celebrities or high-profile public figures are generating massive sums of money when using Finance Phantom.

It seems this fraudulent trading platform is a very effective baiting tool. Our staff received multiple complaints from victims who initially invested a small amount of money, but eventually ended up losing thousands of pounds. It was really heart-breaking to read what some of the victims had to say.

The people who are responsible for orchestrating this sham are affiliate networks and media agencies. These networks partner with CFD (contract for difference) brokers that provide the trading arena and liquidity. The partnership format is all but too well-known. The affiliates are the ones tasked with providing paying customers, and the CFD brokers pay them referral fees. This type of scheme is usually referred to as revenue-sharing, and it is widespread in the gambling and Forex industries.

Finance Phantom Broker Check: When we enrolled in order to conduct our real money deposit test, the broker we were coupled with was named Cryptovest Global. We checked! This broker is does not have a license that allows him to legally trade on behalf of clients or manage their investments. The only thing we were able to find is an address in Moldova.

Legitimate businesses have a company secretary, incorporation documents, and a valid phone number. Nothing like that was to be found anywhere on the site. These types of businesses are usually designed to conceal the real identity of the owners. Finance Phantom is no different and should be viewed as a scam trading platform.

At this point we really understood that we were about to get defrauded. Still, despite everything we had to go through the entire process in order to complete our investigation. The man we had the displeasure of speaking with on the phone was named Peter Huber.

All Peter cared about was getting us to invest large amounts of money. We told him that we were not interested in investing more before seeing some reasonable returns, but that didn’t help. In fact, nothing helped and he kept badgering us and calling using different phone numbers.

So, if you really have your mind set on investing with the Finance Phantom scam trading app, we recommend you think twice. Our review really explains in detail why this is simply another get-rich-quick scheme. If you end up losing your money don’t say we didn’t warn you. You can also forget about getting a refund, nothing works with these charlatans.

Official Finance Phantom Website, Login Page, and Member’s Area: We tracked 12 (Twelve) websites that claim to be the “official” software and trading app. They are all equally worthless trading systems.

Scam Evidence

Contents

- 1 Scam Evidence

- 2 Finance Phantom Fake News

- 3 Manipulated Live Profit Results

- 4 Finance Phantom Regulator Warnings

- 5 Fake Finance Phantom Testimonials

- 6 Fake Finance Phantom Reviews

- 7 What Is Finance Phantom, How Does It Work, And Who Is Behind It

- 8 Finance Phantom Review

- 9 Our £250 Deposit Test And Impressions

- 10 Finance Phantom Complaints:

- 11 Letting The Facts Speak For Themselves

- 12 Review Methodology

- 13 What Others Are Saying

- 14 Strategies And Backtesting

- 15 Pros And Cons

- 16 Legal And Regulatory Aspects

- 17 Personal Information And Privacy Protection

- 18 Finance Phantom: A Secure Trading Environment?

- 19 Leveraged Trading

- 20 Compatibility With Popular Crypto Exchanges

- 21 What Is The Difference Between a Broker And A Cryptocurrency Exchange?

- 22 Cashier: Deposits And Withdrawals

- 23 Trustpilot, Reddit, Social Media and Various Forums

- 24 Bonuses, Comps, and Freebees

- 25 Finance Phantom FAQ

- 26 Taxes: Am I Required To Declare Income?

- 27 How To Protect Yourself From Scams

- 28 Tested Alternatives

- 29 Verdict

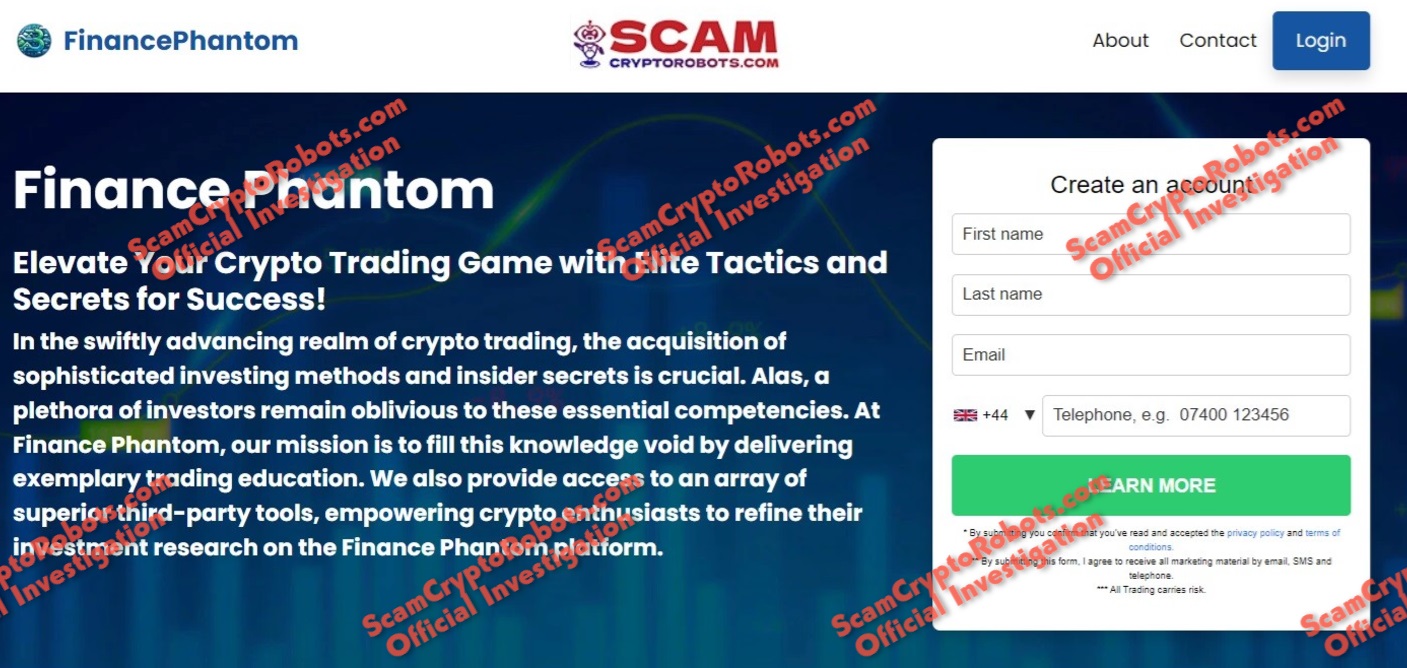

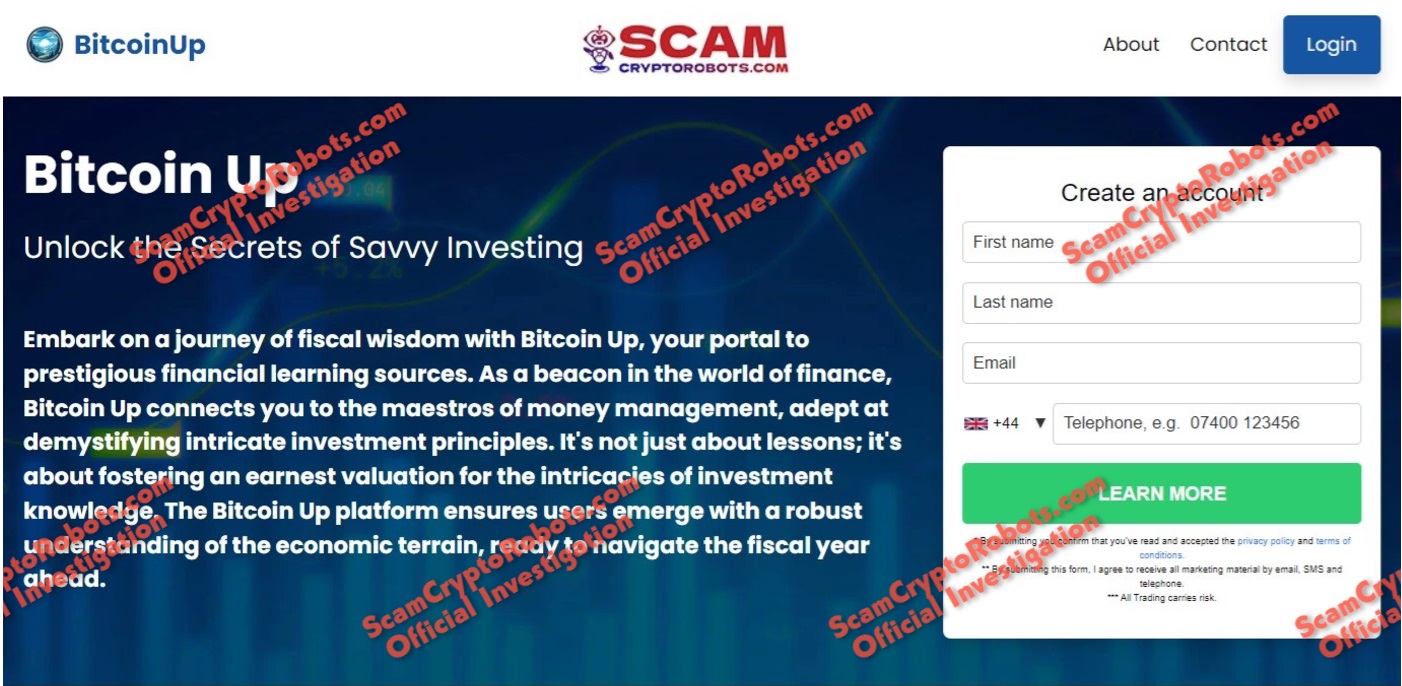

Alright, so here we have one of the Finance Phantom websites. As you can see the site is making all sorts of claims about how to “elevate” your “crypto trading game” and become rich overnight.

Right below we can see that the same exact website is making similar promises, only the name is different. Everything else is the same i.e. the design, registration form, and menu at the top.

This means we are dealing with a copy/paste job and this kind of fraudulent activity is almost always associated with affiliate networks. We refer to this type of scheme as a “production line” scam. It means that the networks use one template and rotate the logo and content based on specific operational and marketing constraints.

Finance Phantom Fake News

There are at least 2 active fake news campaigns now featuring Keir Starmer and Sophy Ridge. In both cases viewers are exposed to highly deceptive advertising tactics. In the example below we can see an image of UK Prime Minister Starmer raving about Finance Phantom and how successful it has been for him.

We have also seen at least 4 other more campaigns featuring wealth gurus or celebrities from Canada, France, Australia, and Spain. In all cases the format is the same, the only thing that changes is the names.

Manipulated Live Profit Results

Here is the Finance Phantom live results section. If you look closely you can see that the dates are static and stuck on old or outdated trading times. To explain, these “live profit results” and anything but live.

Some scammer just tossed up a random date and expected customers to overlook this error. Truth be told, he was correct to assume this since most people don’t notice these little oversights. Thankfully, our researchers specialize in exposing scams and we immediately noticed it.

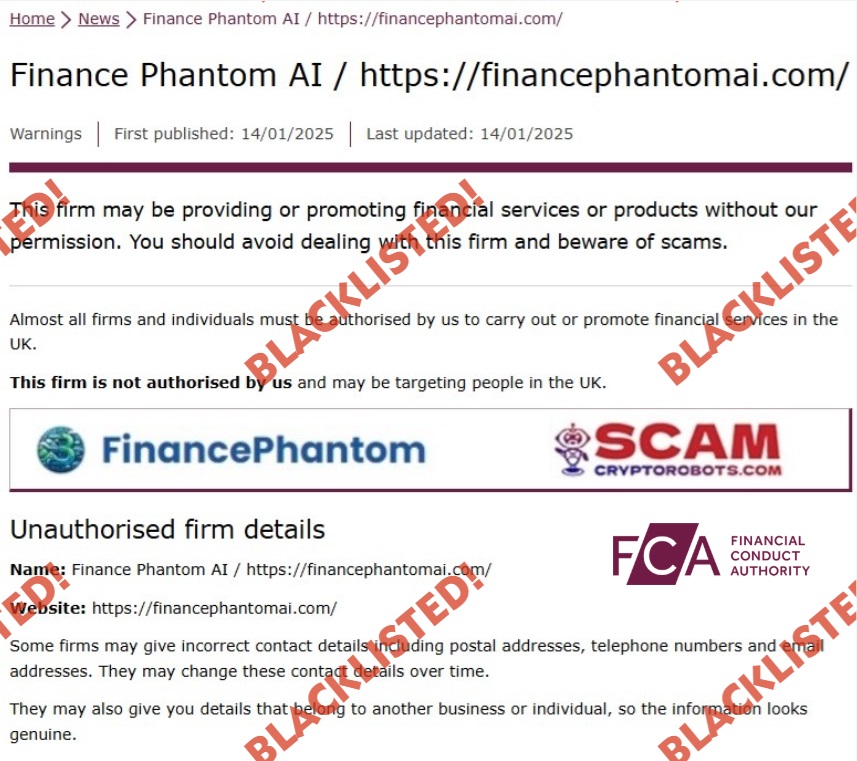

Finance Phantom Regulator Warnings

Well, Finance Phantom really made the “A list” when it comes to online scams. A number of financial regulators have blacklisted it after advising customers that it is not registered in any legal jurisdiction and for that reason not “authorized to solicit investors”.

In this case we have chosen the FCA in the United Kingdom (see above), but Finance Phantom is also blacklisted by ConSob in Italy, CSA in Canada, FMA in New Zealand, FSMA in Belgium, the CNMV in Spain and the AMF in Quebec. This is a very impressive track record given the fact that Finance Phantom has been around for just a few months.

Fake Finance Phantom Testimonials

Here is just one of many fake testimonials we were able to identify while doing some research. If you take a look you will see that “Ryan” is saying that this software helped him make “$8,000 in less than 7 days.”

A quick Google image search reveals that “Ryan” is not a “real” person. He’s being used to peddle tooth paste, furniture, and office equipment.

Fake Finance Phantom Reviews

There are multiple fake Finance Phantom reviews, and in some way they are all related to Finixio (a dirty digital marketing agency). We exposed Finixio on our website and have proven that they have legal issues with a few country regulators. Make sure to do your due diligence and conduct proper research before believing any bogus review websites.

What Is Finance Phantom, How Does It Work, And Who Is Behind It

The Finance Phantom scam is merely a cheap marketing ploy made to look like a cryptocurrency trading robot. This fake signals app is supposed to execute buy and sell orders on auto-pilot without any need for human intervention. Affiliate networks and media agencies are responsible for promoting this hoax. They work closely with CFD brokers who receive the customers and have to convince them to invest. Once an account is funded the affiliates are rewarded according to predetermined contract rates. Payments for new investors can reach staggering amounts of up to £1500 per new investor.

Finance Phantom Review

Here’s another shameless freshly-baked scam bought to you by the Finixio charlatans. It’s always interesting to see how con artists keep using greed to trap and deceive potential victims. The use of fake or exaggerated claims of easy money is used excessively as a baiting mechanism. In fact, it works so well that Sienna from Somerset reached out to tell us how she was cheated out of over £7000 by her account manager Noah Davies.

Sienna told us that at first things seemed to work fairly smooth, until her initial balance was depleted. That was when she started receiving a deluge of phone calls from very rude and pushy sales reps. According to her, the people on the phone had foreign accents and were absolutely determined about getting her to keep investing. Some of the sales tactics the agents used included creating a sense of urgency and making passive-aggressive overtures that lead from small to larger financial commitments.

It seems Sienna is not the only victim who fell victim to these scammers. Our staff received no less than 7 complaints from individuals who got their wallets fleeced. Grievances ranged from a low severity action such as frequent promotional emails, all the way to highly severe fraudulent activity such as illegal use of credit card details. In most cases victims were from the United Kingdom, however our information shows that Canada, France, Spain, and Australia are also targeted countries.

Our £250 Deposit Test And Impressions

It’s interesting to note that when we invested our initial deposit we were told that the credit card transaction will need to be in cryptocurrencies. To explain, the initial deposit was charged to our credit card in British Pounds, but it was done by a shady crypto-wallet based in Romania and converted into Bitcoin. So we had to send them documents and also pay them an extra fee just to have a funded account.

Once we finished funding our account we had to complete a set of forms referred to as “KYC” or know your client. They sent us something called a “transact back” form which listed our transactions. We had to sign and approve the amounts as well as send additional documentation such as official ID, bank statements, and utility bills. This was very annoying, but I guess the scammers have to cover themselves so we had to endure some additional suffering and aggravation.

All of this was compounded by additional badgering and phone calls from our new account manager Kris who was absolutely relentless. Kris started to ask us personal questions and it was quite obvious he was trying to establish rapport or some type of personal relationship. This person was as true professional, honestly it was scary how motivating he was. Even when we knew we were getting scammed “Kris” was very convincing and seemed believable as well as friendly.

In short, we we believe Finance Phantom and Cryptovest Global are acting in collusion whilst attempting to defraud newly-registered customers. We have reached this understanding after going through the registration process and investing, so that is our impression and point of view.

Finance Phantom Complaints:

Below is a list of complaints we received from different subscribers who wanted to voice their opinions. Since there are so many, we decided to group them according to category:

Withdrawal Issues – Adele From Cardiff:

“I invested $5,000 with CryptoVest Global, and at first, everything seemed fine. But when I tried to withdraw my profits, they kept coming up with excuses like needing to verify more documents. It’s been three months, and I still can’t access my funds.”

Unsolicited Pressure Tactics – Tristan from Digbeth:

“An account manager convinced me to deposit more money, promising huge profits. When I started losing money, they kept asking me to deposit even more, saying I needed to ‘recover’ my losses. It felt like a scam from the start.”

Hidden Fees and Charges – Chris from Salford:

“I opened an account with my Broker because they advertised low fees on the Finance Phantom site. But when I started trading, I was charged outrageous spreads, overnight fees, and other hidden charges that quickly drained my balance.”

Account Manipulation – Elias from Åland:

“Every time I placed a trade, the platform froze, or my stop-loss orders were mysteriously ignored. It seems like the broker manipulated the platform to make me lose money.”

No Transparency on Trades – Sophia from Edmonton:

“I noticed discrepancies between the market prices and the prices displayed on their platform. I’m convinced they were manipulating prices to profit from my losses.”

No Customer Support – Noud from Bloemendaal:

“When I encountered problems with my account, I tried to contact customer support multiple times. They either didn’t reply or gave vague answers that didn’t solve anything. It’s been a nightmare.”

Refusal To Close Account: Nicholas from Brisbane:

“I decided to stop trading and close my account, but the broker refused and said I needed to make more trades to access my remaining balance. They kept pushing me to stay until I lost everything.”

Once more, we’d like to remind you that this is just a partial list. So try to imagine how many people got scammed by Finance Phantom since most victims just move on with their lives without complaining.

Letting The Facts Speak For Themselves

Once in a blue moon a system emerges from the bowels of the online trading niche that shocks the industry and actually generates profits. Sadly, Finance Phantom is not one of those systems. Furthermore, if we simply look at the facts it’s quite easy to connect the dots.

First and foremost the app does not generate profits. Secondly, they keep asking for more money despite the abysmal results. This is not only illogical it’s also fundamentally flawed from any way you look at it. Finally, the staff is rude and inconsiderate.

Review Methodology

Our staff of expert researchers have an academic background in Statistics and Finance. We go out of our way to make sure the review methodologies are numerically sound and cross-checked with statistical or accounting models.

| Summary | Synthesis |

|---|---|

| Define the primary arguments. Either for or against. | |

| Relying on factual information which is either overt or logically sound. | |

| Validating and cross-checking multiple sources of information. | |

| A logic-based approach to problem solving. | |

| Organizing and presenting the information in a clear and transparent way. |

This is done in order to provide our readers with the most precise and factual empirical foundation that lays to logical framework for our review and conclusions.

What Others Are Saying

We sniffed around to check what other review websites have to say about this latest hoax. Here are just a few excerpts.

- Finance Phantom “empowers traders” by allowing them to execute sophisticated strategies easily.

- An affordable trading platform. You will not be charged any fees.

- The platform can be navigated very easily. The UX (user interface) is intuitive and very polished.

- A “distinguished” trading platform with a focus on education and “personalized strategies”

We can go on and on, but it’s plain to see the trend.

Strategies And Backtesting

When reading our Finance Phantom review, potential investors begin to understand that this service does not offer access to even the most rudimentary strategies. For example, legitimate Forex or CFD trading apps will offer you access to strategies like scalping, momentum trading, price action, or retracement. We have not seen anything like that and this is definitely not a good sign.

Backtesting is the process of testing a trading strategy or model using historical market data to evaluate its effectiveness and profitability. The goal is to simulate how the strategy would have performed in the past under real market conditions, providing traders with insights into its potential future performance. This is an essential tool for traders to develop confidence in their strategies and improve their decision-making process in CFD trading. Unfortunately, Finance Phantom does not offer any form of backtesting.

Pros And Cons

Alright, so some of our readers like to have a small pros and cons chart just to outline the main points (for and against).

| Pros | Cons |

|---|---|

|

|

We intentionally kept it very condensed since many readers are impatient and just want the bullet style format. So there you have it, right above.

Legal And Regulatory Aspects

CFD (Contracts for Difference) trading systems operate within a legal and regulatory framework that varies significantly across jurisdictions. Understanding these aspects is crucial for traders to ensure compliance and avoid legal pitfalls or oversights. Licensing is a critical factor. CFD trading platforms must obtain licenses from financial regulatory authorities in the jurisdictions where they operate.

Examples of such regulators include (but are not restricted to) the Financial Conduct Authority (FCA) in the UK, the European Securities and Markets Authority (ESMA), and the Australian Securities and Investments Commission (ASIC). In many cases CFDs are prohibited or have restrictions for retail traders. According to registration requirements, brokers must meet strict criteria related to capital adequacy, transparency, and operational standards to obtain and maintain their licenses.

In our Finance Phantom review, we prove that this platform does not have any type of licensing or even a simple patent for the software. There are no leverage restrictions, negative balance protection, or a dispute resolution mechanism in place. All of these factors and more indicate to us that this trading app is a fraudulent system.

Personal Information And Privacy Protection

Personal information and privacy protection are critical aspects of CFD (Contract for Difference) trading, given the sensitive nature of the data involved. Regulatory requirements, broker policies, and technological measures work together to safeguard traders’ personal and financial information.

According to the GDPR (General Data Protection Regulation), which applies to traders in the EU. Brokers must obtain explicit consent for data collection. They must also provide clear details on how data will be used and allow users to access, correct, or delete their data. If you think that these cheaters care about data integrity and protection you are either delusional or in denial.

Finance Phantom: A Secure Trading Environment?

Ensuring you are trading in a secure environment is critical for protecting your personal and financial information and avoiding fraudulent platforms. Just having an SSL certificate with a padlock will not cut it. Customers need to know that their financial transactions are encrypted via secure communication protocols, like eIDAS certificates, PGP keys, and 3SKeys.

There is also the issue of a transport Layer Security (TLS) which is a fairly standard security protocol designed to establish an encrypted connection between web servers and a browsers. Lastly there are firewall setting or configurations that can be set manually or automatically based on certain criteria. Users are not aware of these security features, but when credit card information is stolen or compromised then people start asking the hard questions.

Pro Tip: Make a point of inquiring about PCI compliance, which is the standard protocol designed to encrypt and protect credit card transactions.

Our tech experts conducted some penetration testing on Finance Phantom: and checked certain firewall settings. Sadly, there is no firewall at all and transactions are deliberately anonymous to make tracing difficult.

Leveraged Trading

Leverage in CFD (Contracts for Difference) trading is a financial tool that allows traders to control a larger position in the market with a relatively small amount of capital. Essentially, leverage amplifies both potential profits and potential losses by enabling traders to borrow money from the broker to open positions that exceed their initial investment.

Leverage is expressed as a ratio, such as 10:1, 20:1, or 30:1, which indicates how much market exposure you can achieve with your invested capital. Suppose you want to trade a CFD on a stock worth $10,000. With 10:1 leverage, you only need to deposit 10% of the position size, or £1,000, as margin. You gain exposure to the full £10,000 position, but your gains or losses will be based on the entire position size, not just your initial investment.

Finance Phantom provides leverage of as much as 100:1, which basically means that they are creating a risk level which is intentionally enormous. New traders who are uneducated in finance or Forex can, and many time do end up digging a huge hole for themselves and lose much more money than they can afford to.

Compatibility With Popular Crypto Exchanges

Some review websites are claiming that Finance Phantom is compatible with the popular cryptocurrency exchanges. This is a blatant lie and the sites are saying it in order to make the scheme appear to be more genuine or legitimate. A simple Google check will reveal that CFD systems integrate with brokers only. Sadly, most customers don’t bother inquiring before “diving in”.

What Is The Difference Between a Broker And A Cryptocurrency Exchange?

A broker is an intermediary that facilitates buying, selling, or trading financial assets, including cryptocurrencies. Brokers often offer a simplified trading experience and may set their own prices for the assets they provide. Examples for brokers are eToro, Avatrade, Saxo, Plus500, or Robinhood. A cryptocurrency exchange is a platform where users can trade cryptocurrencies directly with one another at market-determined prices. Exchanges act as marketplaces for buyers and sellers. Examples are Binance, Coinbase, or Kraken.

The trading mechanisms differ in the sense that a broker sets the price for the cryptocurrency. You buy or sell directly from the broker rather than interacting with other traders. Offers primarily include Contracts for Difference (CFDs), allowing you to speculate on price movements without owning the underlying asset. An exchange operates on an order book system, matching buy and sell orders from users. You own the cryptocurrency outright when purchasing on an exchange unless you use leveraged products or derivatives.

This leads us to the issue of ownership, which is a crucial differentiating factor. When it comes to brokers you don’t own the cryptocurrency but speculate on its price through instruments like CFDs. Some brokers do allow you to purchase and withdraw actual cryptocurrencies, but that is quite rare. With exchanges you own the cryptocurrency after buying and can withdraw it to your wallet for storage or other uses.

The issues of pricing and spreads also differ with the two. With brokers prices are determined by the broker and may include a spread (difference between buy and sell prices). This is perceived as less transparent compared to exchanges. These offer prices that are determined by supply and demand on the platform. Offers are made according to real-time market pricing with transparent fees.

Fees are always a thorny issue, especially when brokers are concerned. Brokers may charge fees through spreads, overnight financing (for leveraged products), or account management. Fees are often included in the price and may not be explicitly shown. Exchanges typically charge transaction fees for each trade. Fees can vary based on the trading volume, user tier, or payment method.

Regulation is also very important. On the broker side trading is heavily regulated in most jurisdictions to ensure compliance with financial standards. Regulated brokers offer protections like negative balance protection and segregated client funds. Exchange regulation varies significantly by region. Some exchanges are fully regulated, while others operate with limited oversight.

Use a broker if you want a simplified experience, leverage, and a focus on price speculation without owning cryptocurrencies. Use a cryptocurrency exchange if you prefer to own cryptocurrencies outright, trade directly with other market participants, or engage in advanced trading activities. Choose based on your goals, experience level, and risk tolerance.

Cashier: Deposits And Withdrawals

New members enrolling for Finance Phantom will be able to fund their trading account using Visa, Mastercard, or Cryptocurrencies. However, when trying to cashing out customers are almost always unable to or encounter serious difficulties. That’s because the broker is basically using customer funds to bankroll its operations instead of creating liquidity and generating profits based on arbitrage. In other words, the broker is a kind of Ponzi or Pyramid Scheme.

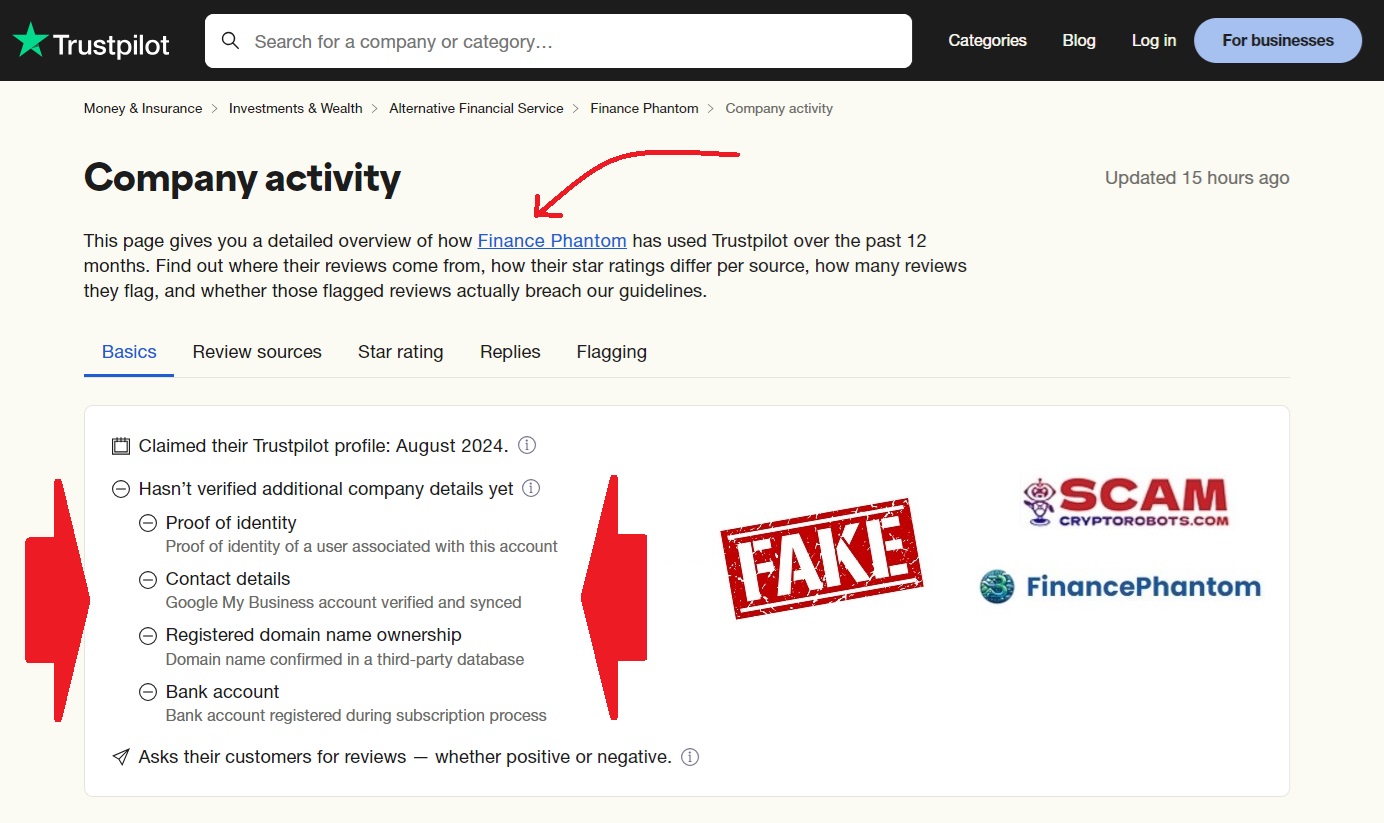

Trustpilot, Reddit, Social Media and Various Forums

We noticed two Trustpilot threads regarding Finance Phantom. One of them has 75 reviews and almost all of them are positive. This didn’t make much sense so we dug in and started checking. The staff found out that the Trustpilot owner profile is shady at best and most likely fake. As you can see below, the owners failed to provide proof of identity, contact details, domain name ownership verification, or bank account details.

Truth be told, these shady scammers actually understand the importance of reputation management. Sadly, Trustpilot is letting them manipulate new customers by allowing them to act in a misleading manner without checking their credentials. Reddit and other social media platforms are no different. We have seen scammers using multiple fake profiles to spread lies and they are getting away with it. This is particularly true when Facebook is concerned. There is very little compliance and scammers are always one step ahead.

Bonuses, Comps, and Freebees

The scammers from Finance Phantom are offering you bonuses and all types of free gifts. If you are smart you will not accept any bonuses since there are definite strings attached. To explain, the bonus that was offered to us had a trading requirement of 35 times the deposit and bonus. That means 250*35 or a total of £8750 in trades have to be made in order to qualify for a withdrawal. Well, in all our history of exposing scams, we have yet to see a trader qualify for a withdrawal after accepting a bonus.

Finance Phantom FAQ

What Is Finance Phantom?

Finance Phantom is supposed to be a a cryptocurrency trading app. According to the sales page, it uses automation algorithms in the trading engine. This is supposed to create a faster and more streamlined trading process.

Can I Use Finance Phantom To Make Money?

No. Finance Phantom is a fraudulent scheme. You will surely end up losing all of your money like we did.

Why Are Other Websites Saying Finance Phantom Is Legitimate?

Certain websites would rather lie and receive referral commissions. We don't believe that is the right way to do business and we stand by our decision.

Why Is This Website The Only One Blacklisting Finance Phantom?

Well, that is not completely true but our reviews definitely tend to get noticed.

I Joined A Telegram Signals Group And Referred To Finance Phantom

Telegram groups are horrible and used by many scammers. They are totally anonymous and the chat history can be deleted.

Taxes: Am I Required To Declare Income?

If you are worried or troubled by how much you will be required to pay in the form of taxes allow us to alleviate your concerns. Taxes are only paid if you generate profits. Finance Phantom is a losing app, so taxes are the last thing that should be on your mind.

How To Protect Yourself From Scams

Protecting yourself from investment scams is crucial to safeguarding your financial well-being. Scammers often use sophisticated tactics to lure individuals into fraudulent schemes. By staying informed and vigilant, you can reduce the risk of falling victim to these scams.

You must understand common red flags such as guaranteed high returns with no risk. Scammers may also try to sell you complex or secretive strategies and use pressure tactics designed to get you to invest. Conducting proper research is warmly recommended, and we are always here to answer should you have any questions.

Tested Alternatives

If you are interested in trying out a tested software then look no more. Our staff periodically tests new systems and monitors the web whilst searching for promising new apps. After we spot a system with potential, we test it and risk our own money. Only after it performs consistently we add it to our recommended section and offer access to our viewers.

Verdict

The Finance Phantom scam trading software and platform is not recommended by our research staff. This service integrates with unlicensed CFD brokers that are here today and gone tomorrow. When conducting our investigation we asked for some type of response from Cryptovest Global and gave them a chance to provide feedback. As a result our account including existing funds was frozen and all communications ceased. Stay away from this software and find something more useful to do with your money.

I joined the Finance Phantom crypto trading platform which promised ‘guaranteed daily profits’ through automated trading. They even had a fake testimonial section with people claiming they’d become millionaires. I put in $300, and the platform worked well initially. Then I was asked to invest more, which I did. But when I tried to withdraw my money, I was told I needed to pay ‘release fees.’ I paid another $2,000, and then they disappeared. I’m totally ruined at this stage and need to go beg for money from relatives. This has just been a total disaster.

Hi Jeff, sorry to hear about that. When it comes to investments it’s always best to read a review from a professional cryptocurrency or finance website. You can always ask a professional. Thanks, S.

I saw the Kier Starmer advertisement on Facebook and registered. After clicking the link was redirected to anther website and had to fill out my details with Finance Phantom. An ‘investment advisor’ contacted me, saying he had inside information about certain cryptocurrency contracts that are set to skyrocket. I invested £2,000, and he sent me fake reports showing incredible growth. When I tried to withdraw, communication stopped. It turned out the company was a front for a scam. Is there any way you can help me get some of my money back? I’m really depressed about all of this.

Hi Sofy, that money is gone and we really don’t recommend any recovery schemes. They are absolutely horrible and demand money upfront before producing results. So try messaging your bank or credit card company. If you invested with Crypto you will not be able to get a refund in any way. Sorry about that.

I came across an ad promising exceptionally high returns through Finance Phantom. The platform seemed legitimate, with a professional website and fake positive reviews. I started with $1,000, and within a week, they showed I had ‘earned’ £500. They kept pressuring me to invest more, so I added another £5,000. When I tried to withdraw, they claimed I needed to pay taxes and fees upfront. After sending another £2,000, all communication stopped, and my account was frozen

Hi Suzanna, this is typical scam artist behavior. I’m really sorry you had to go through that. Thanks for sharing. S.

I was contacted on Telegram by a professional cryptocurrency trader offering to guide me in trading. He claimed to be experienced and showed me fake charts to convince me the trades were real. I invested £2500 through the Finance Phantom software, and initially, the trades seemed profitable. When I asked for a withdrawal, the broker demanded I pay a 20% ‘processing fee’ upfront. When I refused to do that they switched managers and had “Nick Roman”, reach out to me. Nick literally threatened me by saying he will tell the HM Revenue & Customs about my trading account and how I don’t report income. I was so horrified and baffled that I just ended up accepting the terms. Eventually they sent me £500 and told me to remain quiet or they will report me. I feel gutted and have developed a drinking habit after this ordeal. I don’t wish this on anyone.

Hi Roger, you should report these guys to the police. They won’t do anything to you if you tell them you were misled and deceived. Thanks, S

Finance Phantom is now being advertised on Facebook. After responding to an email I was directed to a company called etc markets. Now I can’t recall exactly but it is spelled in a certain format, During the setup process the company first lead me to an cryptocurrency exchange called Jupiter. As far as I know this is an legit company based in Estonia and thought It was part of their business. Knowing very little about bitcoin I proceeded with caution and could not find any negative reviews about etc markets. The first sales assistant was very polite and helped in the verification process. Then the companies crypto expert took control of my investment and pressed hard for more deposits as the market was performing well.

After rejecting an offer to invest more with a bank loan the company advised it would be best to close the account and sent a large tax release bill to finalize the investment. This email from their so called tax department appeared to be very genuine, however after checking this document with tax authorities I then came to the realization this was all fraudulent and just a smoke and mirrors act to extract more deposits from me.

Note that all the actors have Romanian European accents, untraceable telephone numbers and email addresses. There is no broker regulation, and of course no legitimate business address. Their stealth is good however the blockchain system works in way that all all transactions are displayed for everyone to see and only a matter of time when governing authorities press to have them exposed.

Hi Herald. You seem to have stumbled onto a classic scam CFD broker. Thanks for sharing this! S.

They promised me guaranteed profits and even showed me fake account growth. When I tried to withdraw my funds, they kept delaying and asking for more deposits. Eventually, my account was wiped out overnight.

Hi Even, there is no such thing as a guaranteed profit. I know it’s hard to see things clearly sometimes but just so you know for the next time around.

Their so-called ‘account managers’ kept pressuring me to invest more, saying that I needed to add more funds to ‘unlock’ higher profits. When I refused, they became rude and ignored my messages.

Hi Adnan, pressure tactics is what they specialize in. Best wishes, S.

I was making small profits at first, but then they convinced me to take bigger trades. The platform suddenly started freezing, and my trades were automatically closed at a loss. Later, I found out that it was all manipulated.

Hi Alejandro. The scammers always use trade manipulation to make sure you lose. I honestly don’t know how these people look in the mirror each morning.

My name is Ahmed. I believed I was investing smartly with Finance Phantom that was highly recommended in online forums and Telegram. The broker’s website boasted impressive technology and robust customer support, so I felt safe. However, after depositing a substantial sum, I noticed irregularities in my account statements. It wasn’t long before the platform started asking for additional fees under the guise of “verification procedures” and “regulatory requirements.” When I requested a withdrawal, my account was suddenly restricted, and my inquiries were either delayed or completely ignored. I ended up losing most of my investment, and the whole experience left me disillusioned—not just with the broker, but with the promises of a fair digital trading environment.

Hi there, unfortunately Finance Phantom is a viral scam. You are not the only one complaining trust me. Stephan and Team

I made what I now know was a terrible mistake by investing most of my life savings with a Finance Phantom broker that promised easy money and guaranteed returns. At first, everything seemed to work perfectly—the platform was user-friendly, and I even received welcome bonuses that made me feel valued. But as soon as I tried to cash out a portion of my earnings, I was hit with hidden charges and a convoluted verification process that never ended. Calls and emails were met with generic responses, and soon I realized that my funds were being locked behind endless bureaucratic hurdles. It felt as if I had been lured into a trap with sweet promises, only to have the reality turn into a nightmare of financial loss and helplessness.

Hello Clarice. This sounds very typical of CFD scams and unlicensed brokers. Sorry to hear. Stephan

I used trusted a CFD broker through the Finance Phantom software. It appeared to be highly professional and reliable. I was drawn in by promises of high returns and a slick, modern trading interface. I deposited over $3,000, convinced that this was a secure way to grow my savings. However, when I attempted to withdraw my profits, I encountered endless delays. Suddenly, my account was subject to unexpected fees and an avalanche of requests for additional documentation. Every email I sent was met with vague explanations and promises of a “technical glitch” that would soon be resolved. In the end, my money was essentially frozen, and the support team disappeared, leaving me with a profound sense of betrayal.

Hi Vincent, sorry to hear that. Stephan and Team

I made a decent profit trading with Finance Phantom, but when I tried to withdraw my funds from my broker account my requests were ignored. Their customer service kept making excuses, and eventually, they stopped responding altogether!

Hi Mihajlo. Yes, this sounds very familiar and we have seen similar complaints related to this bogus trading app. S

My broker’s account manager kept convincing me to deposit more money, promising ‘guaranteed returns’ with the Finance Phantom app. As soon as I invested a larger amount, I started losing trades suspiciously. When I questioned them, they told me I needed to deposit even more to recover my losses.

Hello Oskar, this is really typical behavior where scammers are concerned. They always want you to invest more.

I noticed that the Finance Phantom and the broker’s trading platform would freeze or execute trades at unrealistic prices, always in their favor. When I contacted support, they told me it was ‘market volatility.’ I checked with other brokers, and their charts looked completely different! This is a total scam.

Hi Hugo. Sorry you had to go through all that. S

They offered me a ‘bonus’ when I signed up through Finance Phantom, but later I found out that I couldn’t withdraw my own deposits or profits unless I met impossible trading volume requirements through my broker Crypto Investments Global. It was just a trap to keep me trading until I lost over €4500.

Hi Emil, that’s a substantial amount of money. Try calling your bank and see if you can salvage some of that money. Thanks, Stephan

I registered after seeing an advertisement on Facebook with Ed Sheeran and right from the start noticed strange price movements that didn’t match market data. My stop-losses were being triggered at prices that didn’t exist on other platforms. Finance Phantom is definitely a scam and they are manipulating trades with the brokers. Horrible.

Hi Liz, yes this is very much how the con artists operate. Thanks for sharing. S

I saw a fake BBC ad with Phillip Schofield and Holly Willoughby. Out of nowhere, my positions were closed even though I had enough margin. When I asked for an explanation, I got a vague response about market volatility. I’ve had enough of the get-rich-quick schemes after losing over 5000 Quid. Any way to get my money back?

Hi Teddy. That money is gone. Please make sure do check our website for reviews next time. Real sorry to hear about that. S

I thought I signed up with the official Finance Phantom website, but it turned out to be a clone website with a slightly different URL. They stole everything and keep calling me and asking me to keep investing. This is totally insane!

Hi Quentin. It really doesn’t matter since all of the Finance Phantom sites are equally fraudulent. Check our review. Thanks, S

I received a 2,000 Euro trading bonus when I deposited 5,000 Euros. I thought it was a nice perk until I tried to withdraw some of my profits. Suddenly, they told me I couldn’t withdraw anything because I hadn’t fulfilled the trading volume required by their bonus terms. These terms were never clearly explained to me—they were buried in a long list of conditions I never agreed to explicitly. The volume they expected me to reach was over $1 million in trades. It’s basically impossible unless you’re a full-time trader using massive leverage, which of course increases the chances of losing everything. It was clearly a trap.

Hi Miklos, I’m guessing this is not what you were expecting. I recommend you call you local law enforcement official and report these crooks.

After months of good communication and some small profits, I finally felt comfortable enough to invest a large amount. I wired €25,000 into my trading account, and that’s when everything changed. The platform began to lag, support stopped answering emails, and the account manager who used to call me weekly suddenly became unavailable. A few days later, I couldn’t even log in. Their entire website was taken down, and the company disappeared. I later learned this was a clone of a legitimate broker, and I had fallen for a very sophisticated scam.

Hi Gustavas, that’s really a lot of money. Please try reaching out to your bank to see if you can resolve this. Thanks S.

My assigned ‘account manager’ was very friendly and persuasive. He told me I had a great instinct for trading and should increase my investment to maximize profits. He constantly encouraged me to use high leverage, saying that’s how successful traders make money fast. I followed his advice because I trusted him. Within two weeks, I went from having a healthy balance to a total wipeout after some strange margin calls. The platform didn’t even reflect real market data. When I asked for an explanation, they said it was due to ‘high volatility’ and basically blamed me for taking the risk—even though they were the ones pushing me into it.

Hi There, I hope you didn’t lose too much money. Thanks for informing us. S.

It all looked above board at first. Slick platform, responsive support team, and my ‘account manager’ Nick was smooth as hell. I deposited £1,500, traded conservatively, and brought my account up to around £4,000. Tried to withdraw £1,000 just to see how long it would take. That’s when the circus began. Suddenly I needed to resubmit documents they’d already approved. Then it was ‘processing delays’, ‘banking issues’, ‘compliance backlog’. Absolute bollocks. After a week, they stopped replying altogether. Chat’s offline, phones ring out, and emails bounce. I’ve been mugged off—straight up robbed by these conniving wankers. Don’t trust a bloody word they say. Scam artists, the lot of them.

Hi Edgar. Sorry to hear that. S

They told me they were regulated under EU law and flashed some official-looking document from a made-up offshore authority. When I checked the regulator’s website, nothing. Zilch. No listing, no oversight, no bloody legitimacy. They’re not regulated by the FCA or any real European authority. I had already transferred £8,000 by the time I figured it out. Tried to pull it out? No response. It’s a complete con job. Professional-looking front, shiny website, charming reps—but all smoke and mirrors. These pricks are preying on people who are just trying to make a better life. I’m absolutely livid. It’s theft, pure and simple

Hello Marge. This platform is anything but regulated. Shame!

They took my savings and did a runner. I’d been trading with them for about three months. Everything seemed legit. Support was helpful, my account manager checked in regularly, and they even let me withdraw small amounts. That was just to build trust, I realise now. When I wired in £25,000, thinking I’d scale up my strategy, everything changed. Manager vanished. Support went radio silent. Within a week, the platform started glitching, and then I couldn’t log in at all. A few days later, the website was offline. Completely f*cking gone. They lifted my savings and disappeared into the wind. These bastards are professional thieves—organised, methodical, and heartless. I’ve got nothing left but regrets.

Hi James, Sorry to hear that. Finance Phantom is really viral these days.